New Emergency Cannabis Tax Regulations Approved

By Lauren Mendelsohn, Esq.

February 3, 2023

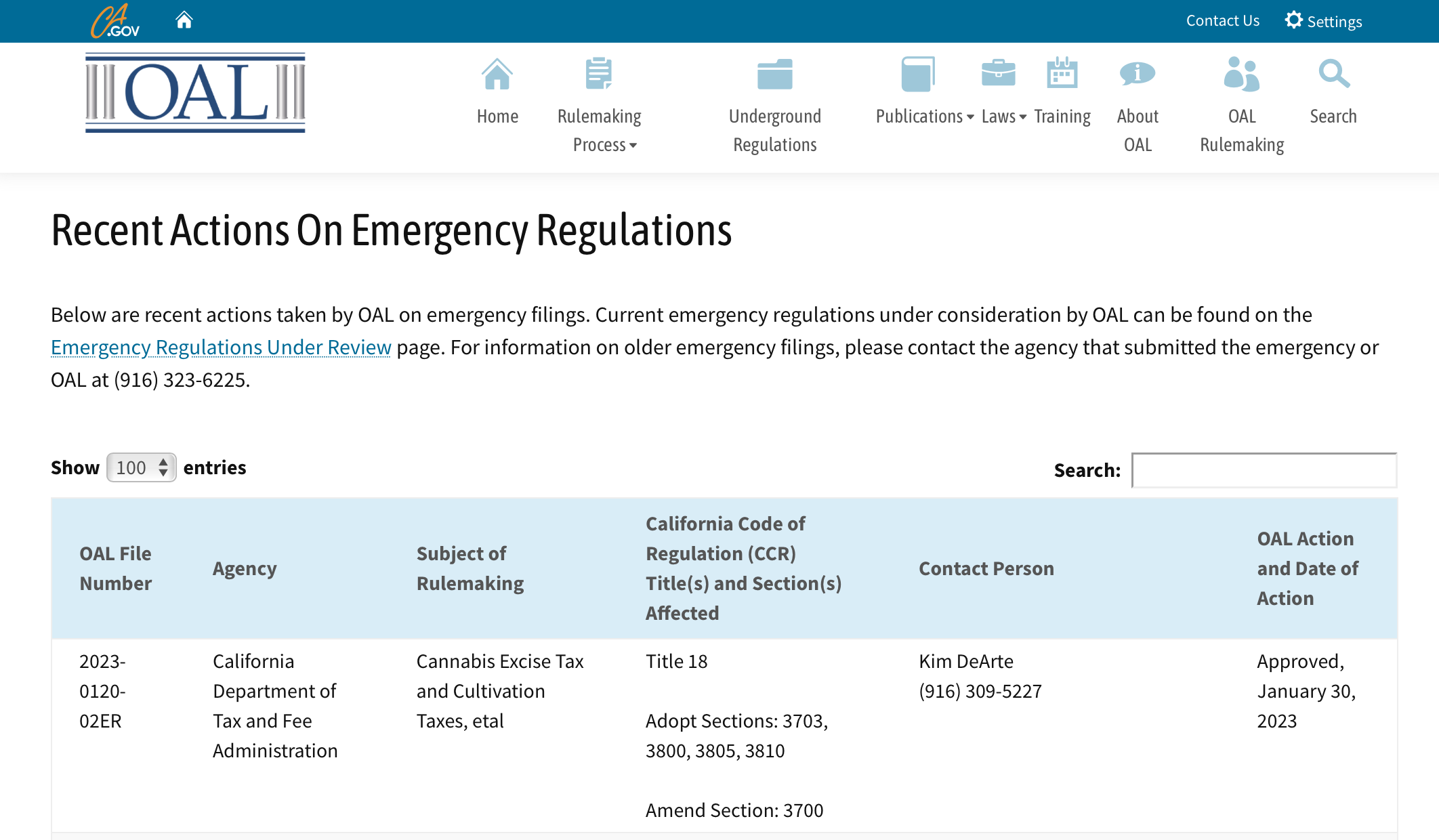

On January 30, 2023 the California Office of Administrative Law (OAL) approved emergency regulations related to cannabis taxes that were proposed by the California Department of Tax and Fee Administration (CDTFA).

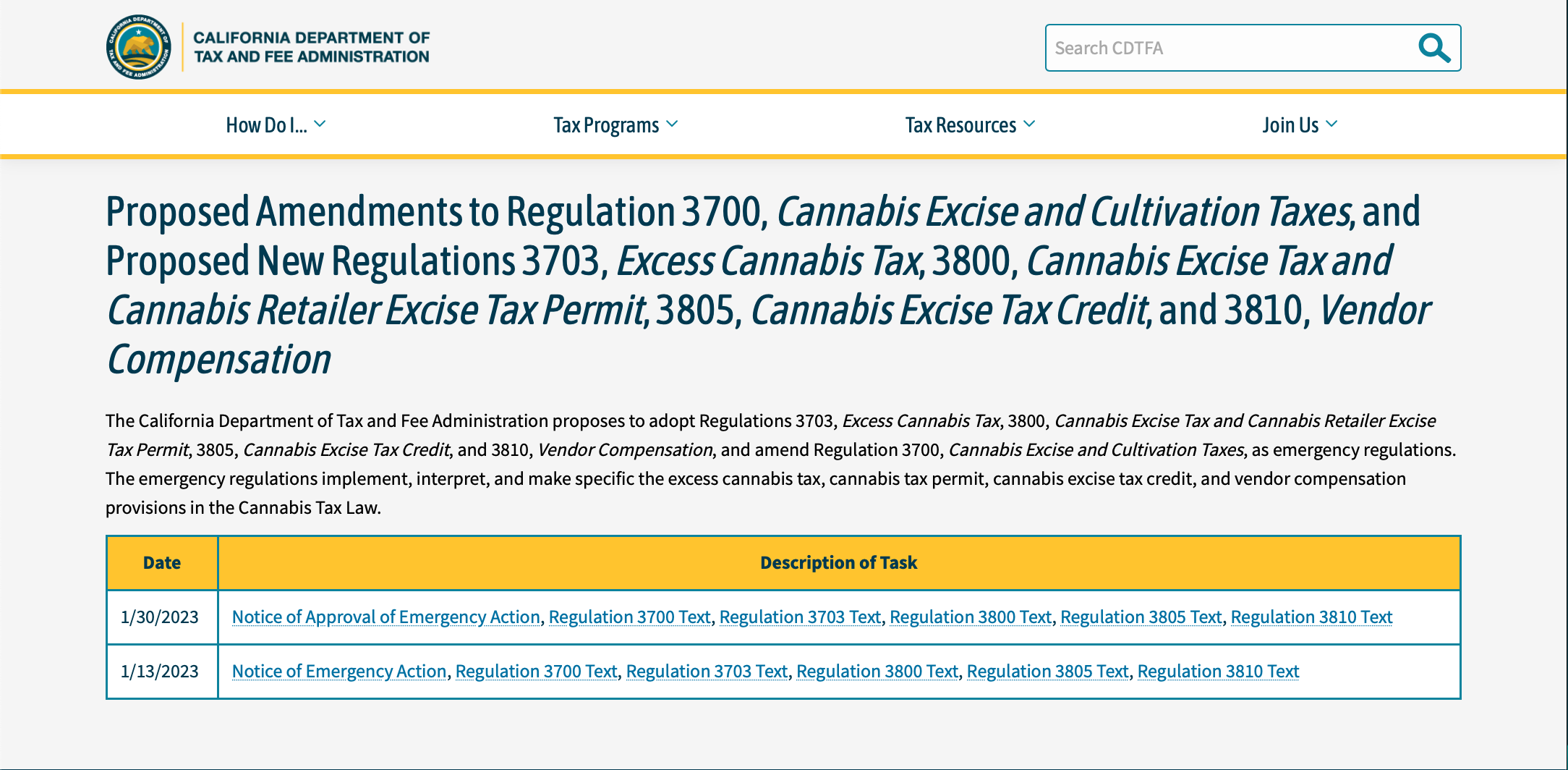

The approved rulemaking package consists of amendments to Section 3700 (Cannabis Excise and Cultivation Taxes) of Title 18 of the California Code of Regulations, and the addition of new Sections 3703 (Excess Cannabis Tax), 3800 (Cannabis Excise Tax and Cannabis Retailer Excise Tax Permit), 3805 (Cannabis Excise Tax Credit) and 3810 (Vendor Compensation) of Title 18 of the California Code of Regulations.

These changes came about in response to Assembly Bill 195 which was adopted by the State legislature and signed into law by California Governor Gavin Newsom last year. We previously discussed that bill and its impacts here and here. To summarize, AB-195 eliminated the cannabis cultivation tax, modified both the collection and calculation method for the cannabis excise tax, and created a new program for certain eligible retailers to retain a portion of the cannabis taxes collected as vendor compensation.

The newly-approved emergency regulations elaborate on how these changes to the cannabis tax law will work in practice. We anticipate that CDTFA will update their Tax Guide for Cannabis Businesses resource to incorporate and link to these new regulations, though as of the time of this post, such has not been done. In the meantime, businesses can refer to this page to access the approved regulations.

Stay tuned for more on this developing story.

This information is not intended to, nor should be construed as, legal advice. For specific questions regarding cannabis tax laws and regulations, please contact the Law Offices of Omar Figueroa at 707-829-0215 or info@omarfigueroa.com to schedule a confidential legal consultation.