Complying with California’s Rules for Medical Cannabis Donations

By Lauren Mendelsohn

February 14, 2022

California has a long history of medical cannabis use by patients. It was the first State in the U.S. to legalize cannabis for medicinal use in 1996, and a thriving market of medical cannabis collectives and cooperatives existed here prior to adult-use legalization in 2016.

An important tradition held by many cannabusinesses is providing free medical cannabis to patients who lack easy access to or can’t afford it. Under the original version of the Medicinal and Adult Use Cannabis Regulation and Safety Act (MAUCRSA) there was no way to exempt donated medical cannabis from the cultivation and excise taxes which apply to all cannabis products sold in California. This predicament was solved by Senate Bill 34 (2019), which created a legal pathway to exempt cannabis intended for donation to medical patients from the cannabis taxes that would otherwise apply.

SB 34 has been codified into various sections of the Business and Professions Code as well as the Revenue and Taxation Code, and the Department of Cannabis Control (DCC) and California Department of Tax and Fee Administration (CDTFA) have both adopted regulations pertaining to this topic. These provisions include:

- Business & Professions Code § 26071

- Revenue & Taxation Code § 34010

- Revenue & Taxation Code § 34011

- Revenue & Taxation Code § 34012

- Revenue & Taxation Code § 34012.1

- Revenue & Taxation Code § 6414

- 18 Cal. Code of Regulations § 3700

- 14 Cal. Code of Regulations § 15411

To summarize, medical cannabis intended for donation which has been properly documented as such in the track-and-trace system is not subject to the cultivation tax, excise tax, or sales and use tax. See Revenue & Taxation Code §§ 34011, 34012, 6414. However, if medical cannabis designated as being intended for donation is sold, the licensee who sold the cannabis would be responsible for these taxes. See Revenue & Taxation Code § 6414. Additionally, if the medical cannabis is not properly designated for donation in METRC, the taxes will apply. See Rev. & Tax Code § 34012.1.

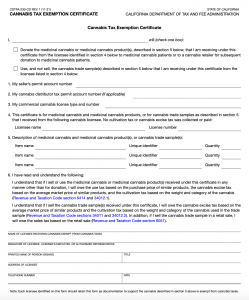

Cultivators and retailers can both designate cannabis goods for donation; however, once a licensee has designated medical cannabis goods for donation, a subsequent licensee in control of the cannabis goods should not change this designation. See Business & Professions Code § 26071. Additionally, licensees must document transactions involving medical cannabis intended for donation to patients carefully. The CDTFA has a “Cannabis Tax Exemption Certificate – Form CDTFA-230-CD” that can be used as proof that the medical cannabis goods are intended for donation and thus exempt from cultivation, excise, and sales & use taxes. See Revenue & Taxation Code § 6414. (This form can also be used for tax exemptions for trade samples, which we will discuss in a future post.) Retailers who provide free cannabis to patients must also note this on the applicable sales invoice or receipt. See Business & Professions Code § 26071.

Cannabis Tax Exemption Certificate

In terms of product compliance, medical cannabis goods donated to patients still must comply with the testing, packaging and labeling. Furthermore, the daily quantity limits applicable to all cannabis goods produced for the commercial market still apply to cannabis donated to patients. For patients, this limit is eight (8) ounces of cannabis per day; as well as twelve (12) immature plants. See 14 Cal. Code of Regs. § 15409.

Failure to pay taxes due by a licensee could result in a penalty of at least one-half of the tax owed (which is added to the amount already due), plus potential license revocation. See Revenue & Taxation Code § 34013(f); 18 Cal. Code of Regs. § 3700(k). Other possible penalties are spelled out in Revenue & Taxation Code 34016. Furthermore, Revenue and Taxation Code Section 34012.5 lays out the process to follow if more cannabis taxes are collected from a licensee than should have been, for example if taxes were collected for medical products designated for donation.

Our office recently presented on this topic to members of Origins Council regional partner organizations. The slides can be accessed here and contain further explanation of how to properly handle medical cannabis donations. The CDTFA also published the document “Cannabis Special Notice: Donated Medicinal Cannabis Exempt from Taxes” to provide guidance to operators and the public.

CDTFA Cannabis Special Notice: Donated Medical Cannabis Exempt from Taxes

Stay tuned for an upcoming blog post that will discuss California’s new laws and regulations for cannabis trade samples.

This information is provided as a public educational service and is not intended as legal advice. For specific questions regarding medical cannabis donations in California, or other topics related to cannabis, hemp, or psychedelics in California or New York, contact the Law Offices of Omar Figueroa at 707-829-0215 or info@omarfigueroa.com to schedule a confidential legal consultation.

ATTORNEY ADVERTISING: This post may constitute attorney advertising. The attorney responsible for this advertisement is Lauren Mendelsohn.